This article discusses the Capital Gains Tax (CGT) implications related to the sale of a dwelling, focusing on the main residence exemption.

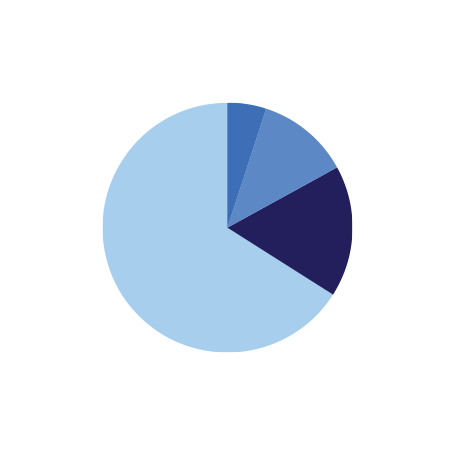

It highlights that a capital gain or loss from the sale is disregarded if the dwelling served as the main residence for the entire ownership period. However, complications may arise if the client was absent for part of the period, leading to considerations of full, partial, or no main residence CGT exemption.

The exemption applies if an individual

- resided in the dwelling for the entire ownership period,

- did not use it for income generation,

- and the land does not exceed two hectares (if the land exceeds two hectares, the taxpayer can select which two hectares the main residence exemption applies to).

(Please note: Main residence exemption is generally not applicable to trusts and companies, but specific exceptions are granted like: dwelling owned by the trustee of a deceased estate)

Factors considered by the Australian Tax Office (ATO) to determine main residence status include living arrangements, duration of residence, intent to occupy, mail delivery, personal belongings, electoral roll listing, and utility connections. If taxpayers promptly move into a newly acquired dwelling, it is treated as their main residence from the acquisition date.

If the taxpayer’s home, not generating income, remains unused and isn’t replaced as their main residence, they can preserve the full main residence exemption indefinitely,

6 Years Rule

In cases where it generates income, a six-year absence is allowed before a partial exemption applies. This six-year period need not be continuous, and taxpayers can regain eligibility by resuming residence. If the dwelling is rented for more than six years, a partial exemption applies, and the dwelling is not considered the main residence for the exceeding period.

If the taxpayer genuinely moves back in, another six-year period of income-producing eligibility begins. Renting for an additional six years may still qualify for the full main residence CGT exemption upon sale.

Partly Income Producing

If a taxpayer’s main residence includes areas used for income (e.g. renting a room, Airbnb), only a partial main residence exemption applies upon selling the home. The interest deductibility test determines the percentage of floor area used for income, calculated based on the proportion of interest that would be deductible for a hypothetical loan to acquire the main residence. The resulting taxable portion of the capital gain or loss is then determined by the proportion of floor area allocated for income-producing purposes.

In summary, taxpayers encounter unique circumstances concerning the main residence CGT exemption. These variations can impact their tax position, particularly when transitioning in and out of the same dwelling.

Written by: Max Bi M.AccMkt. CPA