There are several important issues that need to be considered when selling a business.

Considering the top marginal tax rate is 49%, the tax implications associated with sale are very important to understand.

Many people and businesses are unaware of the concessions available and pitfalls associated with selling a business.

We can vouch first hand that many fall victim to poor advice, or lack of advice, in this area.

If you’re in business you will come across this situation one way or another, so keep reading…

There are two important areas to understand in relation to capital gains concessions:

- Capital Gains Tax (CGT) Discount

- Small Business Tax Concessions

- 15 Year Asset Exemption

- 50% Active Asset Reduction

- Retirement Exemption

- Rollover Exemption

1. Capital Gains Tax (CGT) Discount

Capital Gains Tax (CGT) is the tax payable on the sale of capital assets. Capital assets include businesses that are a going concern as well as capital assets that have been part of a business. A capital gain arises when the sale price exceeds the cost base of the asset in question.

Capital Gain = Sale Price – Cost Base

Capital Gain Tax = Capital Gain x Marginal Tax Rate

What is a going concern?

This is an accounting term for an entity that has the resources available and needed to operate indefinitely until evidence to the contrary is provided.

Examples

(1) A company manufactures a widget known as widget A. The government impose a restriction on the production, import, export and sales of this widget. If Widget A is the only product that the company makes, the company will no longer be a going concern.

(2) Company B shuts down one of its branches, while still operating the remaining branches. The company is still a going concern because the shutting down of a small part of the business does not impair the company’s ability to function and operate as a going concern.

What makes up the cost base?

The cost base includes the original cost of the asset and any costs associated with acquiring, holding or disposing the asset.

Have you held your asset for more than 12 months?

If so, you are privy to a 50% discount on your taxable gain.

For example – If you purchase an asset for $10,000 in Year 1 and you sell it in Year 2 for $20,000 you are eligible to halve the gain by 50% for tax purposes. In this case, the gain is $10,000. With the 50% discount, the gain reduces to $5,000, which is taxed at your marginal tax rate.

Asset Sale vs Share Sale.

There are two basic ways to buy or sell a business: asset deals or share transactions.

Asset deals encompass purchasing or selling a piece of the business (the business itself, plant and equipment etc.)

Whereas a share transaction usually entails the sale or purchase of 100% of the company’s shares, which in turn transfers ownership of all of the assets which the company needs to operate its business.

Generally, purchases prefer to acquire a business’s assets, not its shares.

Buying shares in a company does not eradicate historic liabilities and will leave you exposed to any debt it may have.

Every business case is different and there may be situations where it makes sense to purchase the shares of a company but it all depends on the complexity and context of the transaction.

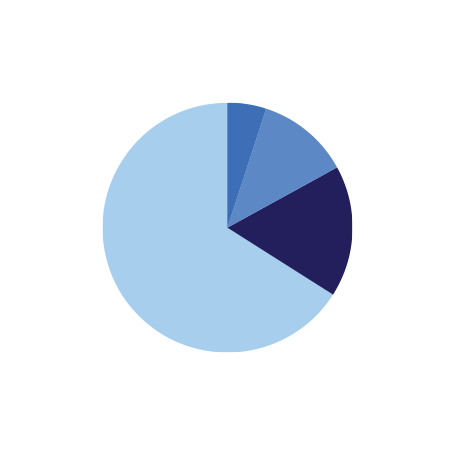

Here is a visual example highlighting the tax results and differences of both sale methods.

ABC Pty Ltd is 100% owned by Husband and Wife.

Assumptions:

-

Both individuals are in the top marginal rate of income tax – 49%

-

Individuals purchased shares in the company for $150,000 over 15 years ago.

| The Key Assets in ABC Pty Ltd | $ |

| Stock (at cost) | 1,500,000 |

| Cash at Bank | 500,000 |

| Plant & Equipment (held for more than 12 months) | 1,500,000 |

| Goodwill | 1,500,000 |

| Total Asset Value | 6,000,000 |

Scenario 1: Sell Shares in ABC Pty Ltd for $6,000,000

| Net Gain Calculation | $ | $ |

| Sale Price (SP) | 6,000,000 | |

| Cost Base (CB) | 150,000 | |

| Capital Gain (CP = SP – CB) | 5,850,000 | |

| General CGT discount of 50% | (2,925,000) | |

| Taxable Gain (TG) | 2,925,000 | |

| Tax on taxable gain @ 49% (TOTG) | 1,433,250 | |

| Net Gain (after tax) (NG = SP – TOTG) | 4,566,750 |

Scenario 2: Sale of business assets from the ABC Pty Ltd

In scenario 2 we are selling the business assets out of the company, rather than selling the shares in the company.

The assets sold include stock, goodwill, P&E (cash at bank is excluded from this transaction).

| Net Gain Calculation | $ | |

| Sale Price (SP) | 6,000,000 | |

| Asset Value (AV) | 5,500,000 | Stock, Goodwill, P&E |

| Gain on Sale (GOS = SP – AV) | 500,000 | Assume stock and P&E are sold at written down value. |

| Tax on Gain (TOG = TR x GOS) | 142,500 | Company tax rate at 28.5% |

| Cash Receipt From Sale (SP – TOG) | 4,857,500 | Sales Price – Tax on Gain |

| Cash at Bank (CAB) | 500,000 | |

| Total Cash in Business (TCIB) | 5,357,500 | |

| Dividend paid to Husband and Wife (DIV) | 5,357,500 | Releases total cash in the company and releases to individuals |

| Franking Credit (FC = DIV x 43%) | 2,303,725 | Dividend x 43% (Franking Credit Rate) |

| Total taxable dividend (Div + FC) | 7,661,225 | |

| Tax Payable @ 49% | 3,754,000 | Marginal tax rate at 49% |

| Less: Franking Credit | (2,303,725) | |

| Total Tax Payable (TTP) | 1,450,275 | |

| Net Gain (after tax) (TCIB – TTP) | 3,907,225 | Dividend paid less total tax payable |

| Scenario | Tax Payable | Net Gain |

| $ | $ | |

| 1 | 1,433,250 | 4,566,750 |

| 2 | 1,450,275 | 3,907,225 |

| Variance | (17,025) | 659,525 |

As you can see, scenario 1 (selling of business assets) is the more favourable outcome in this context. Conflicting tax implications occur when choosing one method over the other. That is why the sales process needs to be well thought out and planned to ensure you are receiving the optimal tax result and net gain outcome.

Did you notice that in scenario 1 we allowed for a 50% CGT discount but in scenario 2 we did not? Here’s why..

There are cases in which holding an asset for 12 months or more does not make you eligible to utilise the 50% CGT discount.

The ATO guidelines outline that the general CGT discount allows you to reduce your capital gain by:

- 50% for individuals (including partners in partnerships) and trusts

- 33.33% for complying super funds.

What entity is missing from this guideline?

If you guessed company, you are correct. Companies are not eligible for the general CGT discount, therefore assets that have been held for more than 12 months will not be eligible for the 50% discount on the gain of sale.

If you are operating under a company structure, you may be under the false pretence that you’re eligible for this concession.

Different business structures reap different benefits and constraints, so it is important to understand the nature of your business and its tax implications and/or benefits.

Now that you have an understanding of CGT basics we will be diving into small business concessions and show examples on how they can save you more tax!

To Be Continued…

Read some of our most popular posts on tax, business and startups:

- Startups Unaware of Special Tax Breaks!

- Growing Your Business While Protecting Your Assets

- Top 10 Countries With Highest Income Tax Rate