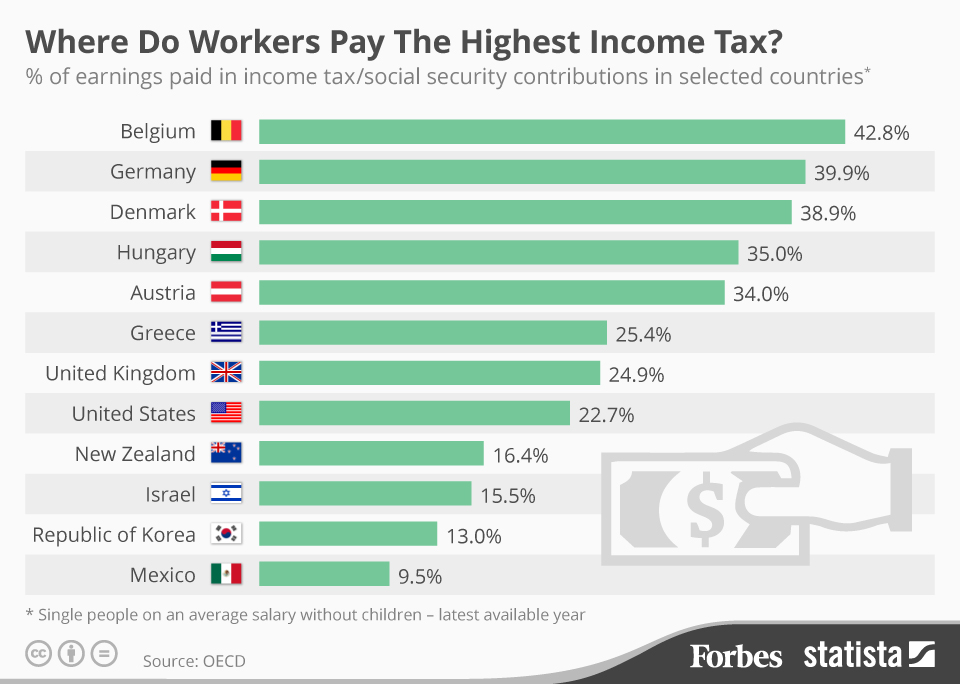

Income tax rates vary highly from country to country and are subject to earnings, marital status and other variables.

In a 2015 post by Forbes, Statista a statistics portal concluded the top 10 countries with the highest income tax rate. According to the OECD a single individual on an average salary with no dependents will have to pay the highest income tax rate.

An article written by the BBC with a study cited from PriceWaterhouseCoopers (PWC) gives an example of a how much a high income earner with a mortgage is left with after tax and social security obligations.

The wage earner is left with the following proportion of their salary, assuming a salary of $400k, is married with two children and has a mortgage of $1.2 million.

- Italy – 50.59% (left with $202,360 of the $400,000 salary)

- India – 54.90%

- United Kingdom -57.28%

- France – 58.10%

- Canada -58.13%

- Japan – 58.68%

-

Australia- 59.30%

- United States – 60.45% (New York state tax)

- Germany – 60.61%

- South Africa – 61.78%

- China – 62.05%

- Argentina – 64.02%

- Turkey – 64.64%

- South Korea – 65.75%

- Indonesia – 69.78%

- Mexico -70.60%

- Brazil – 73.32%

- Russia – 87%

- Saudi Arabia – 96.86% (left with $387,400 of the $400,000 salary)