What does succession and estate planning mean to you, your family and your business?

Planning to hand over the keys of the kingdom, so to speak is a difficult process and one that should be planned and executed with the utmost care to ensure a smooth changeover to the next generation.

Creating a clear and defined path of what is to be achieved through succession helps avoid dispute and opposition to the long-term objectives of the business and its successors. External support in devising and facilitating this process is essential to maintain objectivity & neutrality, while mitigating conflict and underscoring financial well-being and fairness for all involved.

There are two key questions when thinking about succession and estate planning:

- Who is going to take over your business when you retire?

- Who is going to take over your assets when you die?

You have a successful business because you sacrificed and worked hard over many years. You also accumulated a reasonable amount of wealth. You now wish to take a step back or even contemplate retirement or sale; what do you do and how does one go about it?

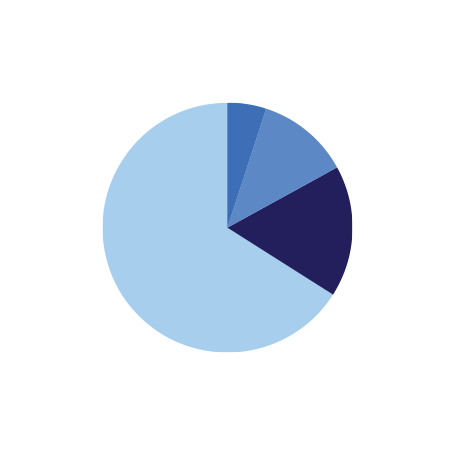

There are 4 groups of people that are key to finding the optimal solution to these questions.

- Family

- It is important towards the end of your working life you gain trust with at least one member of your immediate family. That person should help you with discussing concerns and desires associated with the succession of your business and thoughts relating to your estate after death.

- Accountant

- Your accountant should have an intimate knowledge of your financial affairs, both business and personal. He or she will be able to guide you and ensure that your business and estate is arranged in such a way that suits you and your family.

- Points of discussion will consist if, but not limited to:

- Process of retirement

- Process of sale

- Re-allocation of business assets into various business structures

- Taxation issues

- Selection of key advisers

- Grow and maximise the capital value of your business

- Goals and intended outcomes

- The role of family members

- What will your legacy be?

- Lawyer

- Your lawyer is key in carrying out and ensuring all legal documentation is protected by law. He or she will advise you on all legal matters to do with succession and estate planning, particularly when discussing:

- Wills

- Power of attorney and guardianship

- Your estate

- Your lawyer is key in carrying out and ensuring all legal documentation is protected by law. He or she will advise you on all legal matters to do with succession and estate planning, particularly when discussing:

- Financial Planner

- Before and after death, he or she should assist with investment decisions and where to place assets in order to increase your wealth.