This article is aimed at distinguishing the difference between the value of operating assets and the value of a business’ (or entity’s) equity. These terms are often used interchangeably; however, both deliver varied results, often confusing clients while driving a wedge between their expectations of how they perceive value in their business.

Below is a mechanical explanation as to differences between both these important concepts. One must note that a comprehensive valuation process often involves industry and business specific risk analysis that inform these mechanics.

Enterprise Value aims to assess the value of the business’ operating assets (trading business), incorporating both tangible and intangible assets, including goodwill.

Goodwill is the excess you recognise above and beyond the tangible and physical assets of the business.

Equity Value is that value attributed to the corporate structure of the business and/or entity. It is the sum of The Enterprise value, accounting for surplus assets/liabilities and debt.

While Enterprise Value represents the value of the core operating assets, the Equity Value also accounts for the value of assets and liabilities not directly involved in the business’ core operations and not initially included in the Enterprise Value calculation.

The distinction between these two items can change the perception one has to the overall value of the assets they hold.

How do you rationalise that your business enterprise is worth $10m, however, the entity in which it operates can reduce that value to $5m?

Example:

ABC Pty Ltd is a manufacturing business. We have been advised to provide a value of the shares of this entity. The current shareholders wish to sell the whole company to a third party.

ABC Pty Ltd comprises of the following items:

Core Operating Assets: $8m

Cash: $500k

Goodwill: $2m

Bank Loans: $5.5m

1. Enterprise Value = $10m

This represents the value of core operating assets (Enterprise Value). Assuming we are employing the future maintainable earnings (FME) method.

Figure 1.

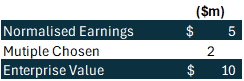

2. Equity Value = $5m

This represents the value of core operating assets (including goodwill) as well consideration for the remaining net book assets/liabilities.

Figure 2.

In summary, a valuation engagement often requires the calculation of both Enterprise Value & Equity Value and as a business owner, prospective purchaser and/or shareholder, it is important you understand the difference between both measures.

How We Can Help

Typical scenarios where you need to value your business:

- Transaction Advisory and Analysis

- Family Law and Litigation Support

- Shareholder Disputes

- Business Succession

- Taxation Requirements

- Financial Reporting Requirements

If you have any Business Valuation queries or would like to discuss any implications for a current transaction, please contact Van Vlassis by using this form

Written by Van Vlassis B.Com(Acc)., C.A.