According to the Australian Taxation Office (ATO), travelling expenses eligible for claim typically include accommodation, meals, and incidental expenses. The overnight travelling expenses incurred during overnight stays away from your home while performing employment duties.

Eligibility for claiming these expenses hinges on specific criteria:

- No Change to Regular Workplace: The traveller’s regular workplace remains the same, meaning there’s no alteration to the usual place of starting and finishing work duties for the employer.

- Short-term Travel: The traveller is away from home for short periods, necessitating overnight stays.

- Short-term Accommodation: Stays are typically in short-term accommodations like hotels or motels.

To be eligible for claiming these expenses, certain conditions must be met.

Firstly, an employee travelling away from their home overnight for work usually isn’t, or can’t be, accompanied by family or have family or friends visit them.

Secondly, you won’t be travelling away from home overnight for work if:

- because of your personal circumstances, you live a long way from where you work

- you’re living at a location where you are working

- you choose to sleep at or near your workplace rather than returning home

In other words, if you want to be closer to a workplace or living at another location while working, the expense cannot be claimed.

Travel expenses that can be claimed encompass various elements:

- Accommodation Expenses: Costs associated with hotel, motel, serviced apartment, caravan stays, or properties booked online.

- Meal Expenses: Expenditures on food during travel periods.

- Incidental Expenses: Minor but necessary expenses linked to work-related travel, such as parking fees, bus tickets, or charges for using phone or internet for work purposes at the accommodation.

- Transport Expenses: Costs incurred for transportation to and from the overnight work destination, including flight expenses.

If the travel serves both work and private purposes, only expenses directly related to work can be claimed. Travellers must apportion their expenses accordingly.

To ensure compliance, maintaining records is imperative. In the absence of applicable exceptions, it’s necessary to retain documentation validating your travel expense claims, which typically include written evidence of your expenses and a travel diary.

Written evidence of your expenses is a receipt or other document (paper, digital or electronic) that you get from the supplier of the goods or services.

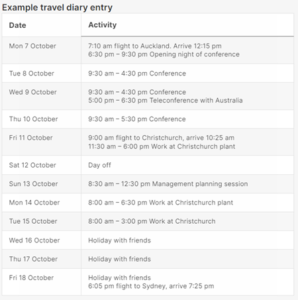

A travel diary serves as a detailed account of your travel endeavors and engagements. It aids in distinguishing between work-related and personal aspects of your journey. Unless certain exceptions, if your travel extends beyond 6 consecutive nights away from home, keeping a travel diary is essential:

In your travel diary, whether electronic or paper-based, it’s crucial to document your movements and activities promptly, either before their conclusion or as soon as possible thereafter. This includes noting:

- where you were

- what you were doing

- when you stopped for meals

- the date, and start and end times, of the activity.