Business owners today have lots to think about and are finding their resources stretched, to keep up with the many regulatory requirements imposed on businesses.

This has led to some owners considering their options, including succession.

The taxation consequences of re-structuring or selling your business can be quite costly if proper care and advice is not sought.

The Small Business Concessions (SBC) play a critical role in reducing the taxation burden while you are considering succession.

Here are some of the key highlights:

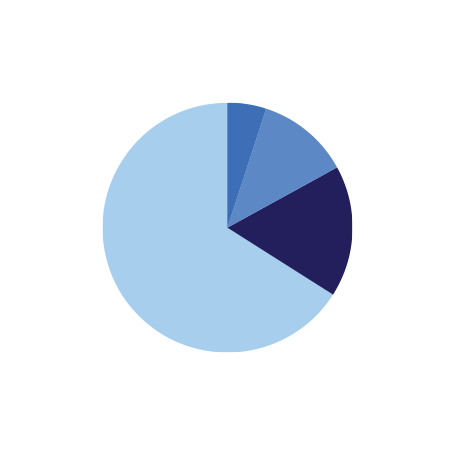

The 15 Year Exemption

A capital gain (CGT) will not apply if the business assets were owned for more than 15 years.

Superannuation contributions of up to the capital gain can be made into a Super Fund without the usual cap limitation.

50% Reduction in CGT

In addition to the 50% CGT discount.

Retirement Exemption

This concession allows a $500K reduction in the assessable capital gain.

Small Business Roll-over

Allows relief if you roll-over the gain into another active business asset – 2 year time limit.

The above concessions apply to small businesses with a turnover of less than $2M, or gross assets less than $6M.

Certain conditions apply however with proper guidance and advice business owners should be able to properly plan their succession.